- Finest total: Square

- Finest for extremely customizable cost workflows: Stripe

- Finest for tailor-made POS setups: Clover

- Finest for interchange-plus pricing: Helcim

- Finest for e-commerce companies with in-person gross sales: Shopify

Discovering the best bank card cost app is essential as the necessity for safe, scalable, and feature-rich cost options grows. With instruments designed to streamline operations, enhance buyer experiences, and assist various cost strategies, these apps empower companies to remain aggressive in an more and more digital enterprise atmosphere.

Associated: Finest cell bank card processing options

Prime bank card cost apps comparability

The bank card cost apps under are my high picks primarily based on pricing, app options, person expertise, and my very own hands-on testing and analysis.

These apps can be found for Apple and Android gadgets and supply methods to just accept bank card funds. Whereas some bank card processing apps solely supply restricted performance, the highest six apps all present ranges of scalability, whether or not by way of quantity processing, extra enterprise instruments, or larger POS setups.

| Our score (out of 5) | Beginning month-to-month price | Faucet to Pay | Transaction price | Integration choices | |

|---|---|---|---|---|---|

| Square | 4.46 | $0 | iPhone & Android | 2.6% + $0.10 | APIs, third-party integrations, Sq. App Market |

| Stripe | 4.31 | $0 | iPhone & Android | 2.7% + $0.05 | APIs, intensive third-party integrations |

| Clover | 4.31 | $14.95 | iPhone solely | 2.6% + $0.10 | APIs, App Market plugins |

| Helcim | 4.28 | $0 | iPhone solely | Interchange + 0.40% + $0.08 | APIs, restricted third-party integrations |

| Shopify | 4.18 | $39 | iPhone & Android | APIs, Shopify App Retailer |

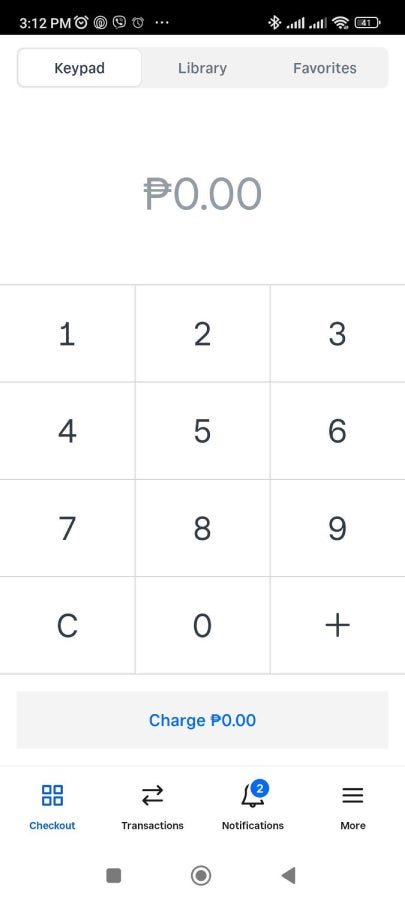

Sq.: Finest total

Our score: 4.46 out of 5

Sq. is a frontrunner within the bank card cost app area, providing a seamless mix of {hardware}, software program, and cost processing that caters to companies of all sizes. Its sturdy ecosystem contains the whole lot from a free point-of-sale (POS) app to superior instruments for stock administration, crew coordination, and buyer engagement.

What units Sq. aside is its ease of use mixed with highly effective options, like Sq. On-line for e-commerce and built-in integrations with accounting and advertising platforms. In contrast to many opponents, Sq. doesn’t cost month-to-month charges for its core companies, making it a great alternative for companies searching for affordability with out compromising performance or scalability.

Why I selected Sq.

Relating to simple and reasonably priced methods to just accept bank card funds, Sq. is considered one of my go-to’s. There are not any upfront prices to make use of the cost app, and its seamless integration of POS programs, cost processing, and ecommerce instruments ensures you’ll be able to deal with each in-person and on-line transactions effortlessly. With assist for Faucet to Pay on each iPhone and Android, Sq. makes accepting contactless funds easier than ever, eliminating the necessity for added {hardware} in lots of instances.

Though Sq. has paid add-ons, I feel its free options are impressively sturdy. It covers important wants, reminiscent of gross sales monitoring, buyer administration, and stock management. These free instruments assist you to begin small and scale as wanted with out a heavy upfront funding.

Pricing

- App subscription — $0 per thirty days.

- Account price — $0 per thirty days.

- Processing charges.

- In-person — 2.6% + $0.10.

- On-line — 2.9% + $0.30.

- Manually entered — 3.5% + $0.15.

- Invoices — 3.3% + $0.30.

- Minimal price for added {hardware} — $0 (free magstripe reader)

Options

- Free Sq. account contains POS, cell app, invoicing, digital terminal, and cost hyperlinks for on-line transactions.

- Sq. helps Faucet to Pay on each iOS and Android, permitting contactless funds with out extra {hardware}.

- Features a free cell card reader with each signup; in-person transaction charges are clear and aggressive.

- Sturdy reporting, stock administration, and buyer engagement instruments are constructed into the app at no additional price.

- Provides add-ons like payroll, advertising, and crew administration instruments at reasonably priced costs for rising companies.

Professionals and cons

| Professionals | Cons |

|---|---|

|

|

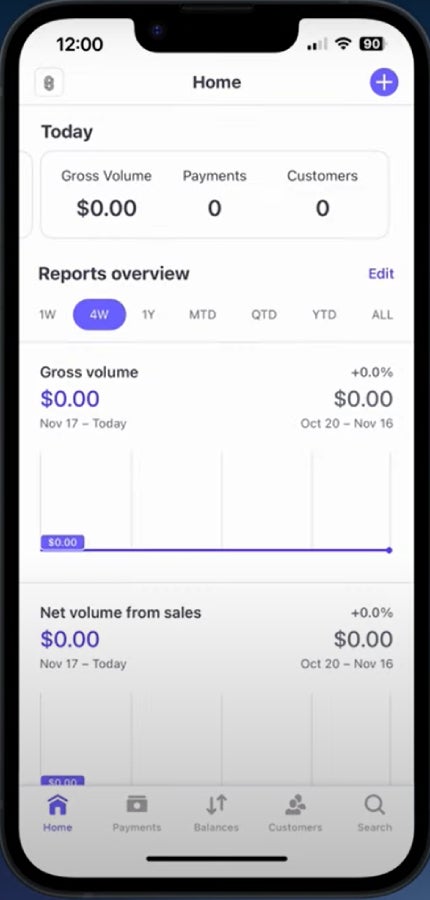

Stripe: Finest for extremely customizable cost workflows

Our score: 4.31 out of 5

The Stripe Dashboard app is a powerhouse for companies that require extremely customizable cost workflows. In contrast to many opponents, Stripe’s app empowers builders and tech-savvy companies with sturdy APIs, enabling tailor-made cost experiences throughout numerous platforms. Its superior options embrace real-time insights into cost exercise, fraud detection instruments, and streamlined administration of subscriptions and invoices.

What units it aside is its unparalleled scalability—whether or not you’re processing just a few transactions or managing world cost operations, Stripe adapts seamlessly. With assist for over 135 currencies and cost strategies, it’s a superb alternative for companies with various buyer bases or worldwide ambitions.

Associated: Finest worldwide service provider accounts

Why I selected Stripe

For companies that require versatile and customizable cost workflows, I feel Stripe is an unbeatable alternative. Its sturdy APIs and developer-friendly instruments make it simple to design tailor-made cost options that combine seamlessly along with your present programs.

Whether or not you’re dealing with subscriptions, market funds, or one-time transactions, Stripe’s flexibility ensures that your workflow aligns completely with your online business wants. Plus, with assist for Faucet to Pay on each iOS and Android, Stripe simplifies contactless funds, lowering the necessity for added {hardware}.

Whereas Stripe affords premium add-ons, its core options—like real-time cost monitoring, superior fraud detection, and multi-currency assist—are extremely helpful on their very own. These instruments allow companies of all sizes to scale effortlessly, handle worldwide transactions, and keep management over their cost processes with minimal friction.

Pricing

- App subscription — $0 per thirty days.

- Account price — $0 per thirty days.

- Processing charges.

- In-person — 2.7% + $0.05.

- On-line — 2.9% + $0.30.

- Manually entered — 3.4% + $0.30.

- Invoices — 3.1% + $0.05.

- Minimal price for added {hardware} — $59 (Stripe Reader M2)

Options

- Extremely customizable cost workflows via superior APIs.

- Multi-currency assist for seamless worldwide transactions.

- Actual-time cost monitoring and analytics.

- Superior fraud detection with machine studying instruments.

- Choices for subscription administration and recurring billing.

- Integration with over 100 third-party apps and instruments.

- Scalable infrastructure appropriate for startups and enterprises.

- Helps digital wallets like Apple Pay and Google Pay.

- Versatile invoicing instruments for B2B and B2C funds.

- Customized branding choices for an expert checkout expertise.

Professionals and cons

| Professionals | Cons |

|---|---|

|

|

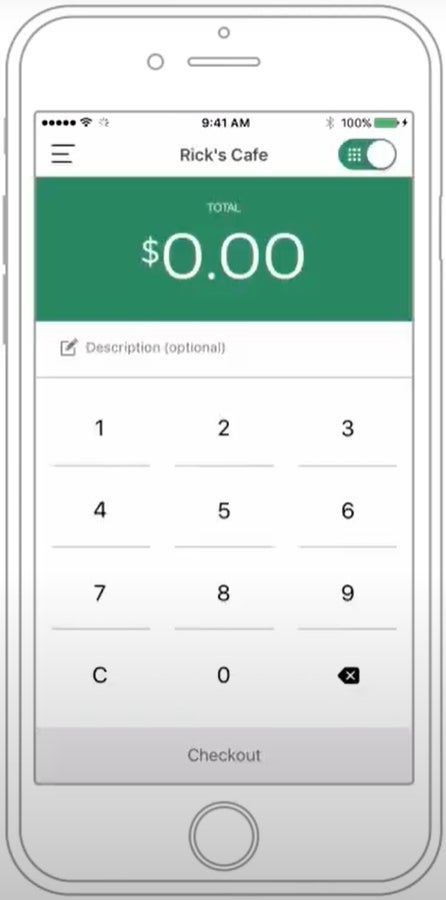

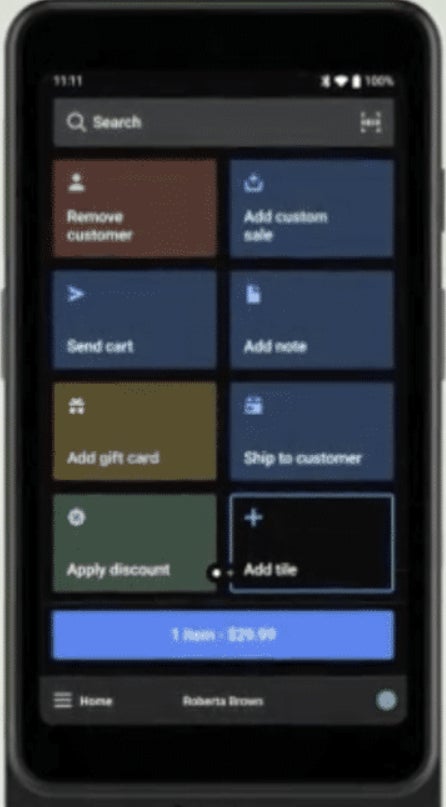

Clover: Finest for tailor-made POS setups

Our score: 4.31 out of 5

Clover stands out for its flexibility in tailoring POS setups to the particular wants of assorted companies. The Clover Go app, paired with its compact card readers, allows companies to just accept funds on the go, whereas its cloud-based dashboard supplies real-time insights into gross sales, stock, and buyer developments.

One of many issues that units Clover aside is its App Market, providing a big selection of third-party integrations and add-ons to customise the system for eating places, retail, or service-oriented companies. This adaptability, mixed with sturdy {hardware} choices and an intuitive person interface, positions Clover as a great answer for companies searching for scalable and personalised cost workflows.

Why I selected Clover

Clover stands out as the only option for companies that want a tailor-made POS setup. I feel it’s particularly helpful that, not like different programs that require companies to piece collectively numerous companies and {hardware}, Clover affords particular plans designed for several types of companies. Whether or not you’re in retail, meals service, or one other business, Clover’s packages include the best mixture of options, software program, and {hardware}, permitting you to get began rapidly with out the guesswork.

Like Stripe, I discover Clover to be very customizable. Whereas Stripe affords this via its sturdy APIs and developer instruments, Clover affords a pick-and-mix strategy with its App Market. It affords all kinds of apps that may be seamlessly built-in into your system. This makes Clover a extremely adaptable alternative, particularly for companies searching for particular functionalities with out a advanced setup course of.

Pricing

- App subscription — $0 per thirty days.

- Account price — begins at $14.95 per thirty days.

- Processing charges.

- In-person — 2.6% + $0.10.

- On-line — 3.5% + $0.10.

- Manually entered — 3.5% + $0.10.

- Minimal price for added {hardware} — $199 (Clover Go)

Options

- Tailor-made POS plans for various industries (retail, meals service, skilled companies, and so on.).

- Customizable {hardware} and software program choices for seamless setup.

- App Market with a big selection of instruments to reinforce performance.

- Accepts bank card, debit card, and contactless funds (together with Faucet to Pay on iPhone).

- Actual-time stock monitoring and gross sales reporting.

- Worker administration instruments, together with scheduling, and efficiency monitoring.

Professionals and cons

| Professionals | Cons |

|---|---|

|

|

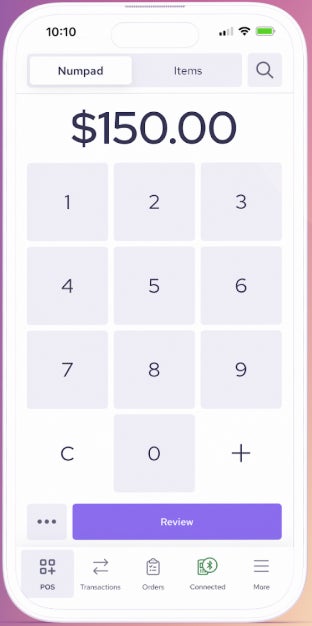

Helcim: Finest for interchange-plus pricing

Our score: 4.28 out of 5

Helcim is a wonderful choice for companies searching for clear and cost-effective cost options, due to its interchange-plus pricing mannequin. In contrast to suppliers that bundle charges into flat charges, Helcim passes via direct interchange prices with a small markup, providing clear financial savings for companies with greater transaction volumes, particularly with its computerized quantity low cost.

The Helcim app enhances this worth by offering an all-in-one platform that features cost processing, invoicing, and buyer administration instruments. With no month-to-month charges and assist for a variety of cost strategies, together with Faucet to Pay on iPhone, Helcim is especially interesting for rising companies that need affordability with out sacrificing superior options or scalability.

Why I selected Helcim

For companies prioritizing cost-effectiveness, Helcim is a wonderful alternative. Its interchange-plus pricing mannequin is a key differentiator—no different cost apps on this checklist supply the identical pricing construction. Other than interchange-plus pricing, I like that Helcim affords computerized quantity reductions, permitting companies to save lots of on processing charges as they develop.

One more reason I selected Helcim is its dedication to offering instruments that scale with your online business. From multi-user accounts to its assist for Faucet to Pay on cell gadgets, Helcim simplifies operations with out including pointless prices. In contrast to many opponents, Helcim contains all its options—with out month-to-month charges or additional fees—making it a complete, budget-friendly answer.

Pricing

- App subscription — $0 per thirty days.

- Account price — $0 per thirty days.

- Processing charges (primarily based on month-to-month transaction quantity):

- In-person:

- $0 to $50K — Interchange + 0.40% + $0.08.

- $50K to $100K — Interchange + 0.35% + $0.07.

- $100K to $500K — Interchange + 0.25% + $0.07.

- $500K to $1M — Interchange + 0.20% + $0.06.

- $1M+ — Interchange + 0.15% + $0.06.

- Keyed and on-line:

- $0 to $50K — Interchange + 0.50% + $0.25.

- $50K to $100K — Interchange + 0.45% + $0.20.

- $100K to $500K — Interchange + 0.35% + $0.20.

- $500K to $1M — Interchange + 0.25% + $0.15.

- $1M+ — Interchange + 0.15% + $0.15.

- In-person:

- Minimal price for added {hardware} — $99 (Helcim Card Reader)

Options

- Clear interchange-plus pricing for cost-effective cost processing.

- Computerized quantity reductions for rising companies.

- No month-to-month charges; all options are included at no extra price.

- Multi-user account entry for collaborative crew administration.

- Assist for Faucet to Pay on iPhone.

- Customized-branded invoices and checkout pages to reinforce professionalism.

- Constructed-in stock administration instruments to streamline operations.

- Superior fraud prevention options to safeguard transactions.

- Complete reporting and analytics for monitoring enterprise efficiency.

Professionals and cons

| Professionals | Cons |

|---|---|

|

|

Shopify: Finest for e-commerce companies with in-person gross sales

Our score: 4.18 out of 5

Shopify’s cost app seamlessly bridges the hole between on-line and in-person gross sales, making it an distinctive alternative for ecommerce companies with bodily retail operations. What units Shopify aside is its deep integration with its e-commerce platform, permitting retailers to handle stock, monitor gross sales, and analyze buyer information throughout channels from a single dashboard.

The app additionally helps Shopify POS, providing versatile {hardware} choices and enabling companies to just accept funds in-store or on the go. With instruments like built-in fraud prevention, dynamic checkout customization, and multi-channel syncing, Shopify ensures a streamlined and environment friendly cost expertise for rising companies.

Why I selected Shopify

For e-commerce companies with in-person gross sales, I feel Shopify is a wonderful choice, particularly for present Shopify e-commerce companies. Its capability to unify on-line and offline gross sales channels is a major benefit, particularly for companies that need seamless stock administration and buyer information monitoring. Shopify’s cost app integrates effortlessly with its ecommerce platform, making it simple to deal with transactions, handle merchandise, and analyze gross sales efficiency multi function place.

One other key cause I selected Shopify is its versatility. Whether or not you’re working a pop-up store, a retail retailer, or an internet market, Shopify’s POS system affords versatile {hardware} choices and helps Faucet to Pay for each Android and iPhone. Its built-in fraud prevention instruments and superior customization choices add layers of safety and performance.

Pricing

- App subscription — $0 per thirty days.

- Account price — begins at $39 per thirty days.

- Processing charges.

- In-person — 2.6% + $0.10.

- On-line — 2.9% + $0.30.

- Minimal price for added {hardware} — $49 (Shopify Faucet & Chip Card Reader).

Options

- Built-in cost processing with Shopify Funds.

- Unified on-line and offline gross sales via a central dashboard.

- Assist for Faucet to Pay on iPhone and Android gadgets for cell funds.

- Customizable checkout experiences to align along with your model.

- Superior stock administration to trace inventory throughout a number of channels.

- E-commerce integration with instruments for product listings, delivery, and order administration.

- Constructed-in fraud prevention instruments for safe transactions.

- Versatile {hardware} choices for retail and in-person gross sales.

- Complete reporting and analytics for gross sales and buyer insights.

Professionals and cons

| Professionals | Cons |

|---|---|

|

|

How do I select the most effective bank card cost app for my enterprise?

Deciding on the best bank card cost app depends upon your online business’s particular wants and development targets. Listed below are the important thing elements to contemplate:

- Pricing mannequin: Search for clear pricing that aligns along with your transaction quantity and cost preferences. Think about whether or not a flat price, interchange-plus, or tiered pricing construction works greatest to your finances.

- Supported cost strategies: Make sure the app helps main bank cards, digital wallets (e.g., Apple Pay, Google Pay), and contactless funds to accommodate your prospects’ preferences.

- Options and instruments: Superior instruments like stock administration, reporting, fraud prevention, and buyer administration can streamline operations and enhance effectivity.

- Integration choices: Make sure the app integrates seamlessly along with your present POS system, e-commerce platform, or accounting software program to keep up consistency throughout your workflows.

- Scalability: As your online business grows, the app ought to supply options or add-ons that assist elevated transaction volumes, a number of customers, and extra places.

Methodology

To find out the most effective bank card cost apps, I evaluated over 15 choices primarily based on elements essential for companies of all sizes and industries. Every app was assessed utilizing the next standards:

- Pricing (20%): I analyzed the associated fee construction, together with transaction charges, subscription prices, and any hidden fees, guaranteeing the apps present clear and aggressive pricing for companies.

- App options (30%): Every app was assessed for its cost processing capabilities, together with assist for numerous cost strategies, fraud detection, recurring billing, reporting instruments, and integrations with POS programs or e-commerce platforms.

- Person expertise (30%): I thought-about the benefit of use, onboarding course of, and total design of the apps, specializing in how properly they cater to each day operations and scalability for rising companies.

- Skilled rating (20%): Primarily based on my analysis, business information, and hands-on expertise, I assigned a rating reflecting every app’s efficiency, recognition, integrations, and pricing.

My analysis concerned reviewing product documentation, pricing buildings, person suggestions, and accessible demo environments. The objective was to advocate bank card cost apps that excel in performance, user-friendliness, and worth for companies throughout industries.