Voiding a cheque cancels the fee whereas protecting a file of the transaction. It modifications the quantity to $0.00 with out deleting the main points, making certain correct monetary information and stopping reconciliation points. That is helpful for correcting errors, misplaced cheques, or canceled funds.

1

Acumatica Cloud ERP

Staff per Firm Measurement

Micro (0-49), Small (50-249), Medium (250-999), Massive (1,000-4,999), Enterprise (5,000+)

Any Firm Measurement

Any Firm Measurement

Options

Accounts Receivable/Payable, API, Departmental Accounting, and extra

2

QuickBooks

Staff per Firm Measurement

Micro (0-49), Small (50-249), Medium (250-999), Massive (1,000-4,999), Enterprise (5,000+)

Micro (0-49 Staff), Small (50-249 Staff), Medium (250-999 Staff), Massive (1,000-4,999 Staff)

Micro, Small, Medium, Massive

Options

API, Common Ledger, Stock Administration

3

Quicken Enterprise & Private

Staff per Firm Measurement

Micro (0-49), Small (50-249), Medium (250-999), Massive (1,000-4,999), Enterprise (5,000+)

Micro (0-49 Staff)

Micro

Options

Accounts Receivable/Payable, Invoicing / Billing, Cellular Capabilities, and extra

Right here’s how one can void a verify in QuickBooks On-line and QuickBooks Desktop.

Learn how to void a verify in QuickBooks On-line

Voiding a verify in QuickBooks On-line (QBO) modifications its quantity to $0.00 whereas protecting the main points for record-keeping. It stays in studies however received’t have an effect on reconciliations. If the verify was by no means issued, deleting it is perhaps a greater possibility.

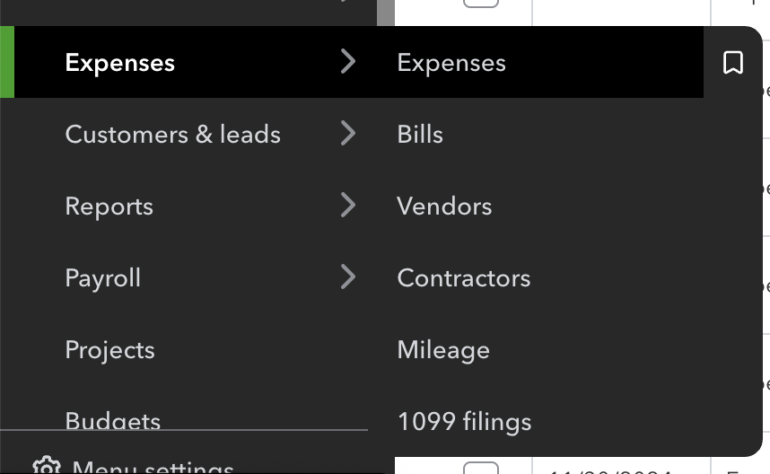

1. Within the left menu sidebar, click on Bills. A dropdown menu will seem and choose Bills.

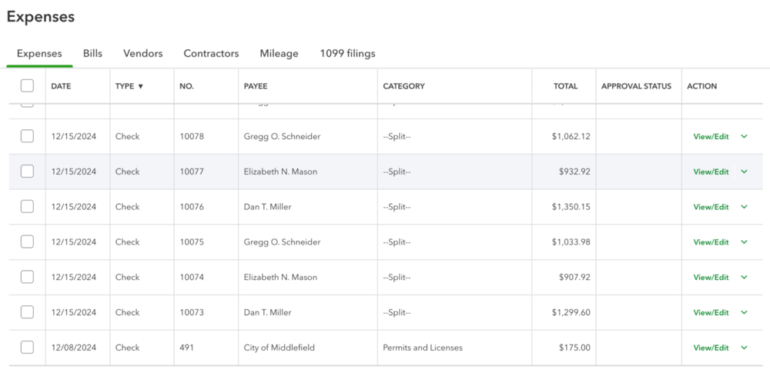

2. You’ll arrive on the Bills web page. Discover the verify transaction you wish to void.

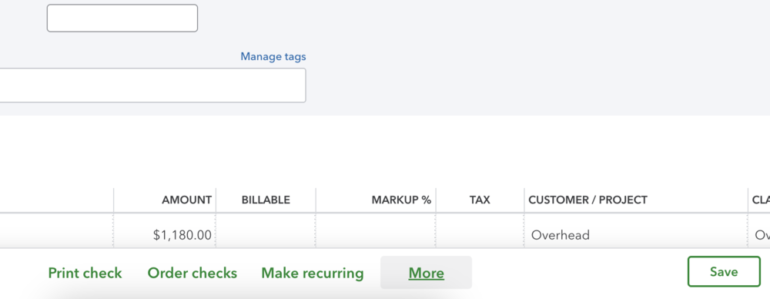

3. Click on the transaction to open the file. When you see the main points, click on Extra on the backside a part of the display.

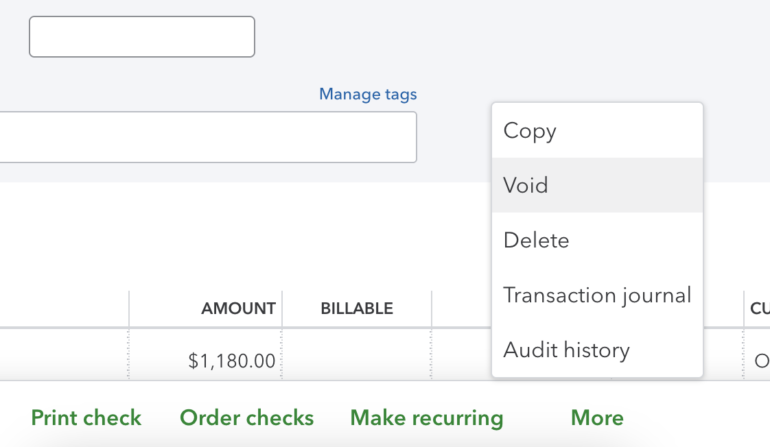

4. A dropdown menu will seem. Choose Void to void the verify.

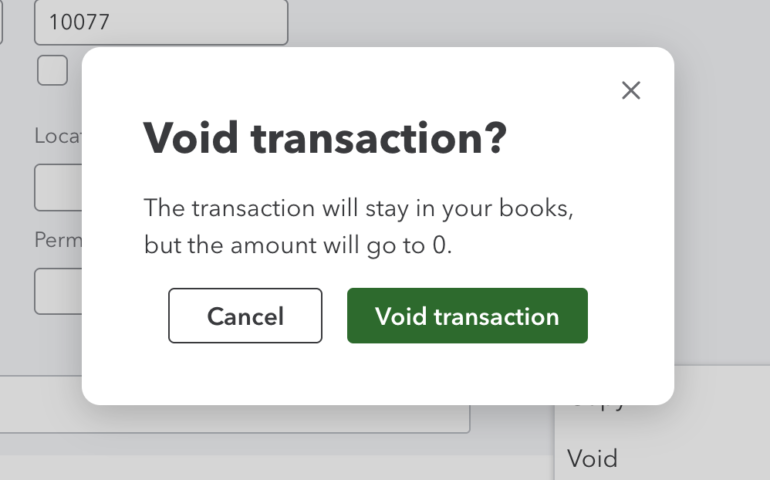

5. A popout field will seem. Click on Void transaction to verify the motion.

While you void a verify in QuickBooks On-line, the quantity modifications to $0.00, however all transaction particulars stay intact, creating a transparent audit path whereas sustaining your monetary accuracy. Voided checks nonetheless seem in studies like the overall ledger with zero-dollar quantities, making certain previous reconciliations keep untouched whereas stopping excellent checks from affecting future ones.

If the verify was created in error and by no means issued, deletion is perhaps extra applicable because it utterly removes the transaction, whereas voiding preserves a file with a zero steadiness.

Learn how to void a verify in QuickBooks Desktop

To void a verify in QuickBooks Desktop, find it within the Test Register underneath the suitable checking account. Voiding units the verify’s steadiness to $0.00 whereas protecting a file of the transaction. As soon as confirmed, the verify stays within the system however received’t impression future balances or studies.

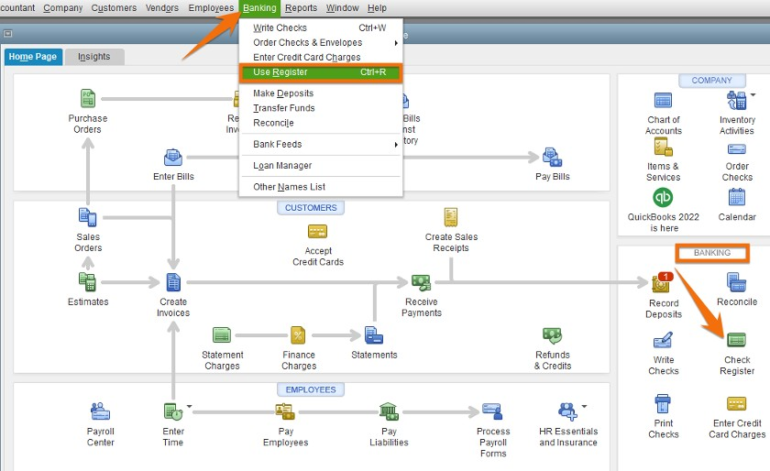

1. Go to the Test Register and choose the checking account the place you wish to void a verify.

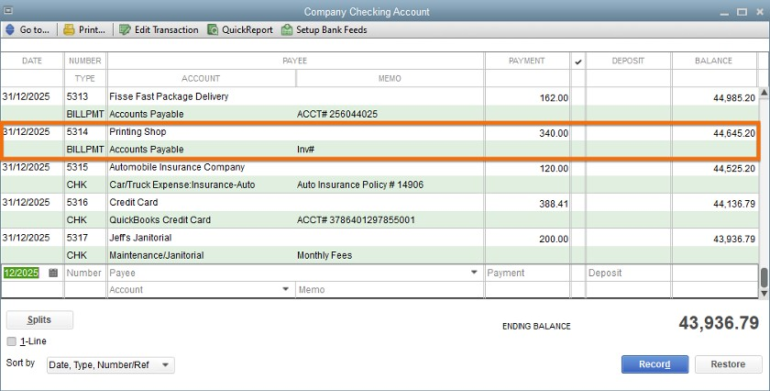

2. Choose the verify you wish to void.

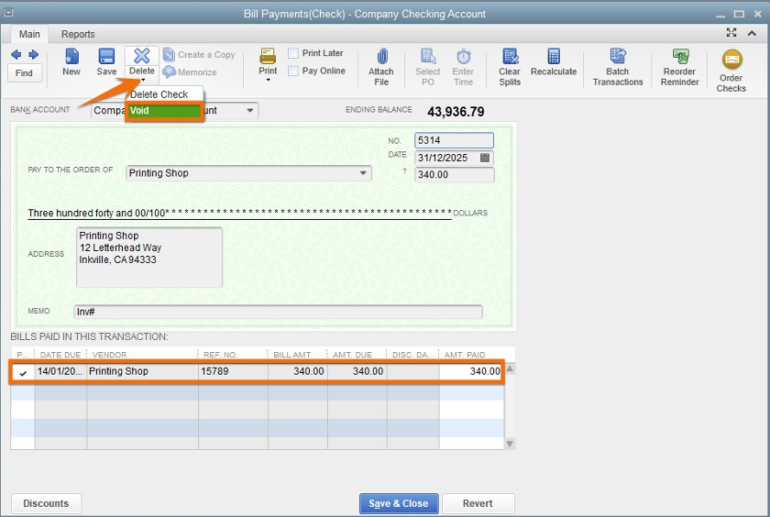

3. Click on Void to zero out its steadiness then click on Save & Shut.

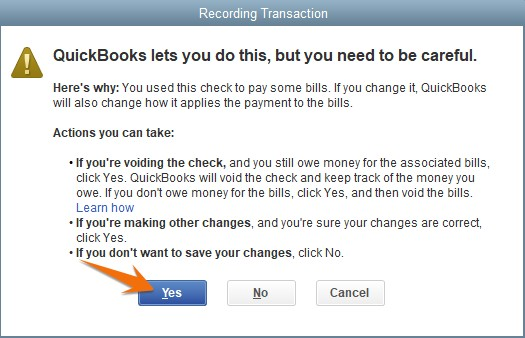

4. Affirm your motion by clicking Sure.

Why you have to void a verify in QuickBooks

Voiding a verify is a safer and cleaner technique to deal with errors and errors. It zeroes out the steadiness however nonetheless retains a file of the transaction for auditing functions. Listed below are some causes when you have to void a verify:

1. There are incorrect particulars

If a verify was written with the mistaken payee identify, quantity, or date, voiding it ensures the inaccurate transaction is adjusted whereas protecting a file of the problem. As an alternative of deleting the verify, which removes all historical past, voiding it retains the main points intact whereas making certain it received’t have an effect on future studies or financial institution reconciliations.

2. Test is misplaced or stolen

If a verify has been misplaced within the mail or stolen, you’ll probably must difficulty a alternative. Voiding the unique verify prevents it from being cashed whereas sustaining a file in QuickBooks. This helps keep away from duplicate funds and ensures the misplaced verify not impacts excellent balances.

3. It’s a duplicate entry

Generally, a verify could also be entered twice by mistake. If the duplicate entry hasn’t cleared the financial institution, voiding it removes the inaccurate file with out disrupting your books. This prevents discrepancies in your financial institution reconciliation and monetary studies.

FAQs on the best way to void a verify in QuickBooks

Can I get well a voided verify in QuickBooks?

No, you possibly can’t reverse a voided verify in QuickBooks as soon as it’s been voided. Nonetheless, the transaction particulars stay in your information with a $0.00 quantity. If you have to restore it, you’ll should create a brand new verify with the unique particulars.

Does voiding a verify have an effect on my financial institution steadiness?

No, voiding a verify doesn’t change your financial institution steadiness. If the verify was already cleared in a previous reconciliation, its impression on the checking account stays. Nonetheless, if the verify was nonetheless excellent, voiding it removes it out of your listing of pending transactions, stopping future discrepancies.