As a solopreneur, you’re chargeable for your small business’s development and dealing with payroll for one worker, together with tax calculations, filings, and record-keeping. Managing all these might be disturbing. Luckily, payroll software program and companies can automate these processes and prevent from potential payroll errors.

Right here’s my checklist of the highest 10 pay processing software program that can assist you run payroll for 1 worker.

1

Deel

Staff per Firm Measurement

Micro (0-49), Small (50-249), Medium (250-999), Massive (1,000-4,999), Enterprise (5,000+)

Any Firm Measurement

Any Firm Measurement

Options

24/7 Buyer Help, API, Doc Administration / Sharing, and extra

2

Rippling

Staff per Firm Measurement

Micro (0-49), Small (50-249), Medium (250-999), Massive (1,000-4,999), Enterprise (5,000+)

Any Firm Measurement

Any Firm Measurement

Options

API, Test Printing, Doc Administration / Sharing, and extra

3

Velocity World

Staff per Firm Measurement

Micro (0-49), Small (50-249), Medium (250-999), Massive (1,000-4,999), Enterprise (5,000+)

Any Firm Measurement

Any Firm Measurement

Options

Worker Database, Multi-Nation Payroll, Onboarding, and extra

High one-employee payroll software program comparability

| Our ranking (out of 5) | Beginning month-to-month worth | Pay runs through cell app | 24/7 buyer assist | |

|---|---|---|---|---|

| Square Payroll | 4.00 | $35 + $6 per worker | Sure | No |

| Justworks | 3.91 | $50 + $8 per worker | No | Sure |

| QuickBooks Payroll | 3.9 | $50 + $6 per worker | No | 24/7 stay chat |

| Gusto | 3.88 | $40 + $6 per worker | No | No |

| Paychex Flex | 3.65 | Customized | Sure | Sure |

| OnPay | 3.59 | $40 + $6 per worker | No | No |

| RUN Powered by ADP | 3.58 | Customized | Sure | No |

| Patriot Payroll | 3.49 | $37 + $5 per worker | No | No |

| Roll by ADP | 3.47 | $39 + $5 per worker | Sure | Sure |

| Deel | 3.47 | $19 per worker | No | 24/7 stay chat |

| *These can finish at any time. Go to the suppliers’ web sites to examine the most recent promotions. | ||||

1. Sq. Payroll: Greatest general

Our ranking: 4.00 out of 5

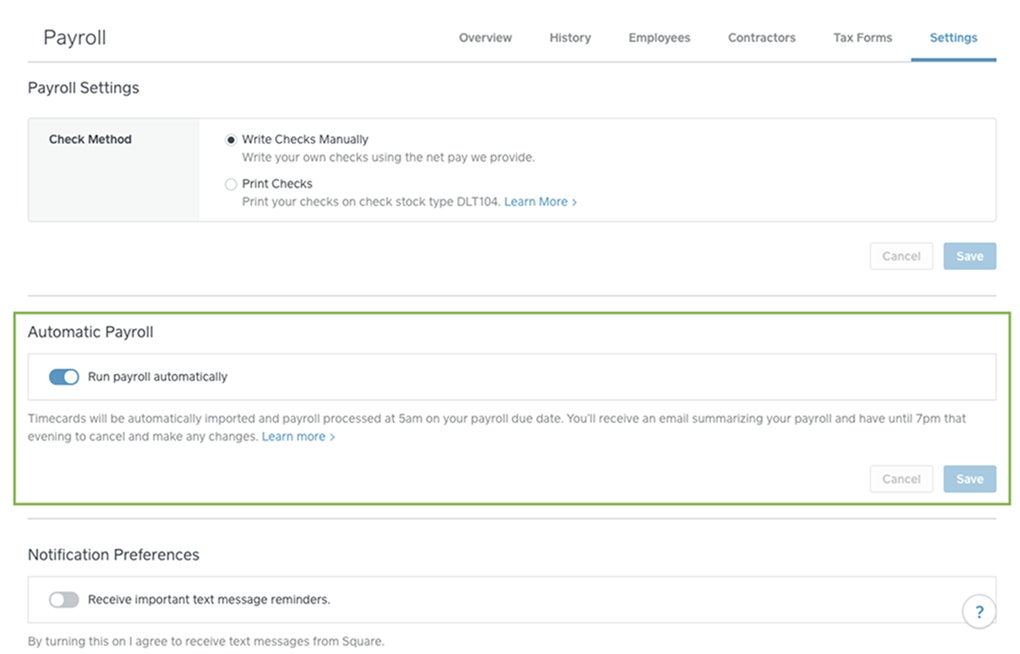

Sq. Payroll helps small companies handle their on-line payroll operations. It runs payroll mechanically and handles tax submitting throughout federal, state, and native tax jurisdictions, together with end-of-year tax reporting. It helps varied worker fee choices, reminiscent of guide paychecks, direct deposits, and prompt payouts through the Sq. Money software. That is in contrast to different suppliers, reminiscent of QuickBooks Payroll, which requires you to improve to its larger plans to get same-day funds.

As well as, Sq. Payroll is appropriate and integrates with shopper fee processing and accounting software program, reminiscent of Sq. POS and QuickBooks On-line. The automated knowledge syncs between Sq. and its accomplice applications make tip monitoring and bookkeeping straightforward.

Pricing

Sq. Payroll affords two pricing plans:

- Full-service payroll: $35 monthly plus $6 per worker monthly.

- Contractor-only payroll: $6 per worker monthly.

With an general rating of 4 out of 5 in my analysis, Sq. Payroll is cheaper than Gusto and OnPay (each with month-to-month charges of $40 + $6 per worker). Nonetheless, it has restricted HR instruments. Sq. Payroll additionally costs an annual payment of $3 per kind if you would like them to mail paper copies of payroll tax types—though digital variations of tax paperwork are free.

Sq. Payroll execs and cons

| Execs | Cons |

|---|---|

| Straightforward integration with Sq. merchandise | Restricted HR instruments |

| Intuitive cell app with payroll options | Lacks 24/7 assist and HR advisory companies |

| Simple system and account setup |

Why I selected Sq. Payroll

In case you have a retail or service-based enterprise, Sq.’s in depth product suite makes it a superb choice for managing funds, point-of-sale transactions, and payroll for one worker. Its totally different merchandise sync simply, and you’ll switch funds out of your Sq. steadiness to the Sq. Money app to pay your self immediately or ship funds to your checking account for two- or four-day direct deposit payouts.

I additionally like its on-line vendor group or discussion board, the place you’ll be able to join with different small enterprise homeowners and Sq. customers. That is useful should you want recommendation on boosting gross sales or have questions on utilizing Sq. Payroll’s options.

Study extra about Sq. Payroll

- Learn the total Sq. Payroll evaluate.

- All for seeing how Sq. Payroll compares to the opposite payroll instruments on this information? Test these out:

2. Justworks: Greatest for compliance assist

Our ranking: 3.91 out of 5

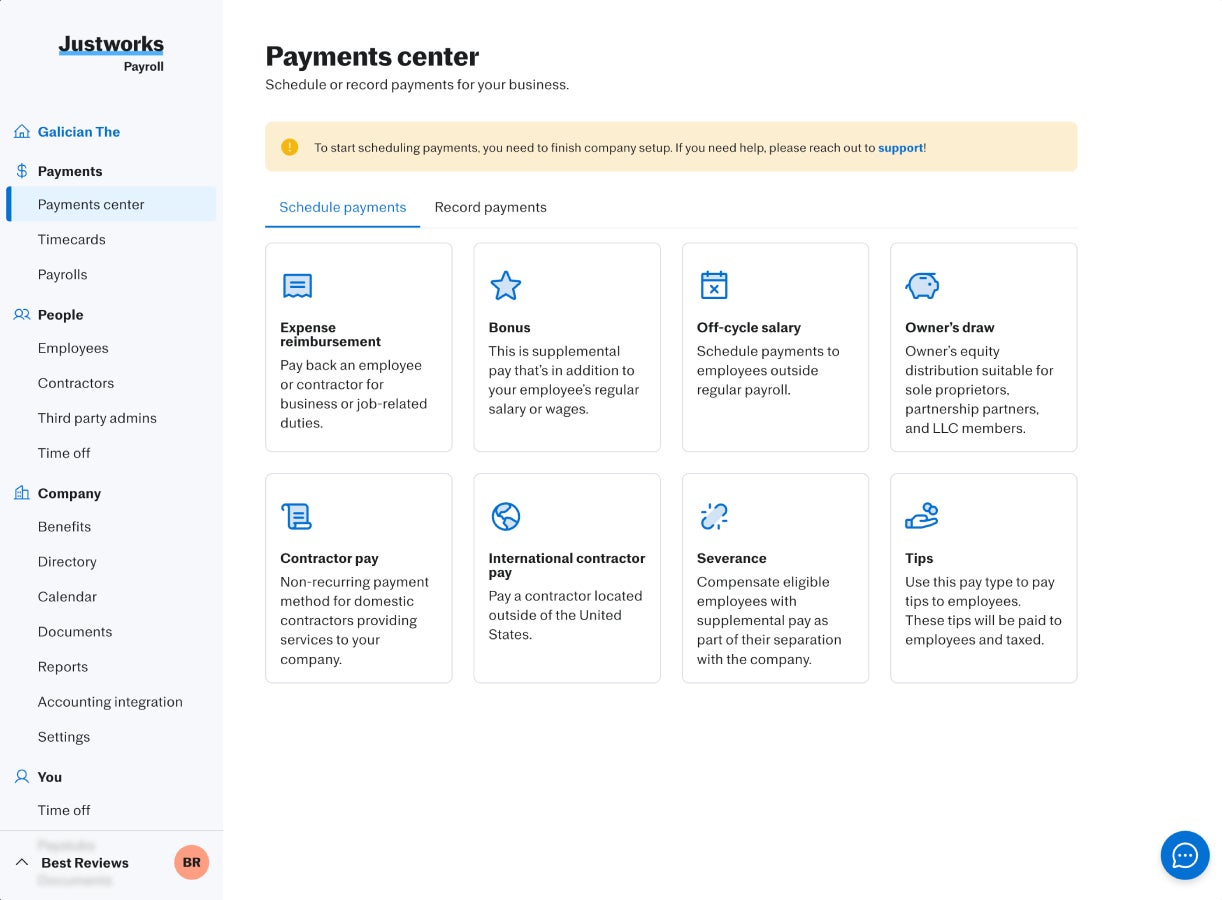

As an expert employer group (PEO) service supplier, Justworks handles the intricacies of pay processing to provide you extra time to run your small business. Nonetheless, other than its PEO service, it has a payroll-only choice that features computerized wage and deduction calculations, tax submitting help, and payroll compliance. That is nice for one-employee companies searching for a dependable payroll device as a result of most PEOs require not less than two workers if you wish to join its companies.

Even with its payroll-only choice, you get devoted cellphone assist and integration choices with accounting instruments like QuickBooks On-line for simple pay knowledge transfers and correct bookkeeping. It additionally offers real-time alerts to assist maintain you on prime of federal and state compliance necessities. This leaves you with extra time operating your small business as an alternative of continually checking labor legal guidelines and federal rules for updates.

Pricing

Justworks Payroll prices $50 monthly plus $8 per worker monthly. This selection doesn’t embrace well being or retirement plans like a lot of the software program on my checklist. Nonetheless, if need to get medical, dental, and imaginative and prescient insurance coverage, its medical insurance add-on for the payroll-only plan prices $8 per worker monthly. Should you determine to increase your small business globally and need assistance hiring and paying worldwide employees, you will get its employer of report (EOR) companies for $599 per worker monthly.

For its PEO companies, Justworks affords two plans:

- Fundamental: $59 per worker monthly.

- Plus: $109 per worker monthly.

With a 3.69 out of 5 rating, Justworks Payroll could also be pricier than the others on my checklist, but it surely affords greater than processing payroll for 1 worker. You get the advantage of its compliance experience as a PEO, so that you’re assured that pay processes all the time meet federal and state rules. You even get devoted assist from HR consultants should you want steerage navigating sophisticated pay-related points. Word that this service usually prices additional or requires upgrading to costly plans with different suppliers.

Justworks execs and cons

| Execs | Cons |

|---|---|

| Its standalone payroll choice comes with devoted cellphone assist and help from HR consultants | Expensive for one-employee companies |

| Clear pricing | Solely pays through direct deposits |

| Various assist choices through cellphone, chat, and a 24/7 assist heart | Worker payouts take 4 enterprise days |

Why I selected Justworks

As a solo worker, dealing with payroll for your self and staying up to date on tax adjustments might be complicated. With Justworks, you don’t have to fret about inaccurate payouts and late tax filings as a result of it should handle these processes. This minimizes the danger of compliance points and tax computation errors, which may result in expensive penalties.

Justworks additionally offers knowledgeable HR and payroll recommendation. Its on-line platform permits you to entry pay-related paperwork and different HR options, like workers onboarding and time monitoring—good for whenever you want extra HR instruments to handle employees in your small enterprise.

Study extra about Justworks

3. QuickBooks Payroll: Greatest for its accounting integration

Our ranking: 3.9 out of 5

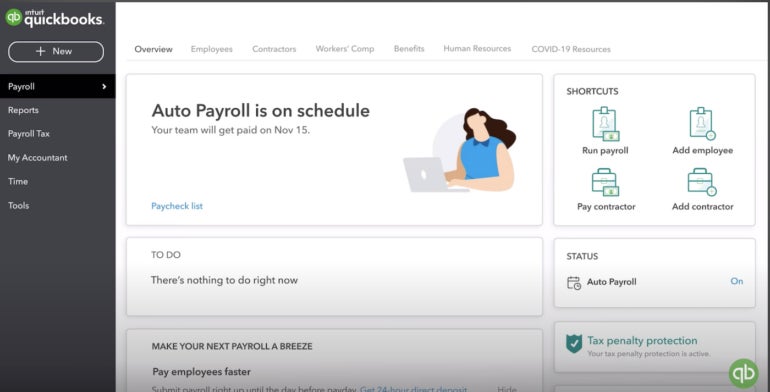

QuickBooks Payroll is one other standard one-business payroll answer with options that can assist you automate payroll processes. The platform can streamline your tax and monetary info to get your payroll processes up and operating. It collects all vital info out of your checking account particulars, tax ID numbers, IRS filings, and W-2s. Over 15 customizable payroll studies are additionally constructed into QuickBooks Payroll, enabling you to view financial institution transactions and tax deductions in actual time.

Along with operating payroll for one worker, it connects seamlessly with QuickBooks On-line. Let’s say you’re utilizing this method to handle your accounting processes. You don’t need to enter pay-related objects to your basic ledger manually—QuickBooks Payroll will mechanically switch the relevant knowledge to QuickBooks On-line for simple bookkeeping.

Pricing

QuickBooks Payroll affords three plans:

- Payroll Core: $50 monthly plus $6 per worker monthly.

- Payroll Premium: $85 monthly plus $9 per worker monthly.

- Payroll Elite: $130 monthly plus $11 per worker monthly.

Should you’re searching for each payroll and accounting software program, QuickBooks affords packages that embrace each programs.

- Payroll Core + Easy Begin: $85 monthly plus $6 per worker monthly.

- Payroll Premium + Necessities: $115 monthly plus $6 per worker monthly.

- Payroll Elite with Plus plan: $184 monthly plus $9 per worker monthly.

For each choices, QuickBooks affords a reduction of fifty% off the bottom worth in your first three months of service. Or, as an alternative of a reduction, you’ll be able to join a 30-day free trial of any plan.

Whereas Patriot’s accounting and payroll packages could also be cheaper than QuickBooks’ bundles (charges begin at $47 + $5 per worker monthly vs $85 + $6 per worker monthly), QuickBooks’ starter bundle has extra accounting functionalities, reminiscent of receipt administration, bill fee reminders, and customizable invoices. Additional, Patriot’s payroll module lacks entry to the medical, dental, and imaginative and prescient plans that QuickBooks affords through its accomplice supplier, Allstate Well being Options.

These functionalities contributed to its general rating of 3.90 out of 5. Nonetheless, it didn’t rank larger on my checklist as a result of its HR options are restricted in comparison with suppliers like Gusto and OnPay.

QuickBooks Payroll execs and cons

| Execs | Cons |

|---|---|

| Straightforward integration between Intuit merchandise with real-time payroll and accounting knowledge updates | Native tax filings are restricted to the Premium and Elite plans |

| Subsequent-day direct deposit included within the primary plan |

Why I selected QuickBooks Payroll

QuickBooks On-line is likely one of the world’s hottest accounting software program, so it’s extremely possible that you simply additionally use the identical accounting system. And should you join QuickBooks Payroll, you get a platform that’s simply as user-friendly and intuitive as QuickBooks On-line. Working with an interface you already perceive is useful, particularly should you’re apprehensive about making widespread payroll errors as you get used to single-employee payroll processing.

Even should you don’t use its accounting software program, QuickBooks Payroll affords automated pay runs and tax funds with quick direct deposit choices. Much like Sq., it has a web based group the place you’ll be able to ask different QuickBooks customers questions in regards to the platform or payroll processing.

Study extra about QuickBooks Payroll

4. Gusto: Greatest for ease of use

Our ranking: 3.88 out of 5

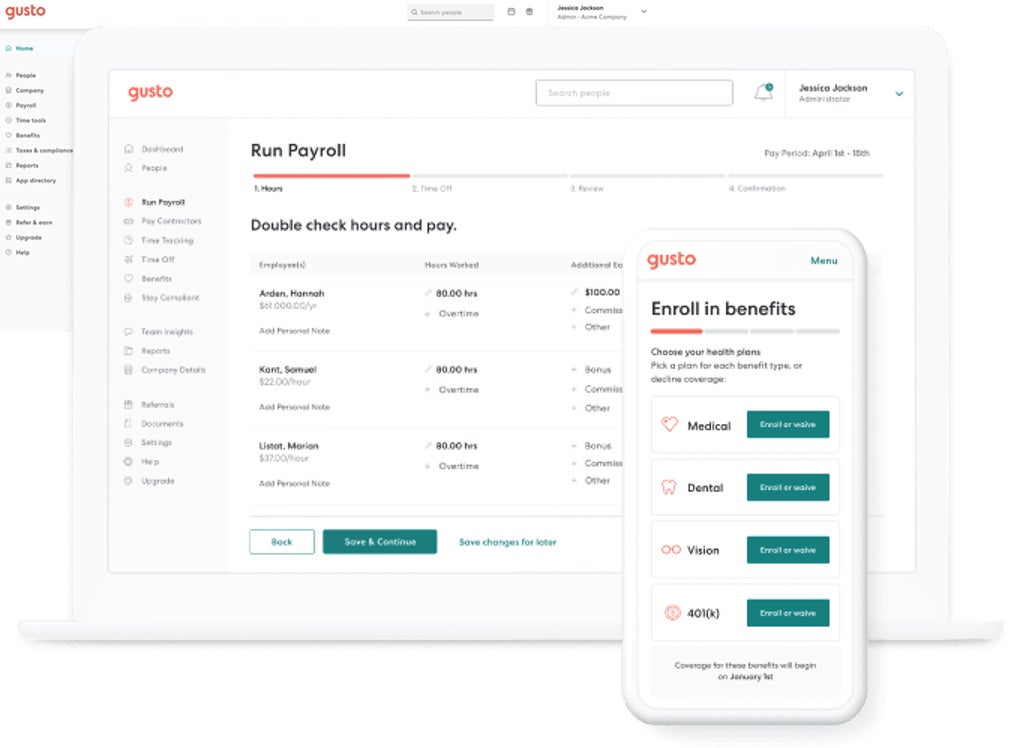

Gusto persistently ranks as probably the greatest payroll software program for small corporations due to its user-friendly interface. It helps one-employee companies navigate payroll complexities by automating most HR- and payroll-related duties. Pay runs solely take a couple of clicks, and you’ll even set it to run mechanically.

It affords primary to premium assist that addresses complaints and questions promptly. With built-in advantages administration and Gusto as your dealer, you’ll be able to depend on its licensed advisors to search out the fitting well being advantages plan. Its Gusto Pockets app additionally offers monetary administration instruments that can assist you construct wholesome spending habits by setting finances limits for purchases and payments, reminiscent of meals and utilities.

Pricing

Gusto’s starter payment of $40 monthly plus $6 per worker monthly will not be as low-cost as Roll by ADP or Deel’s US Payroll plan—priced at $39 plus $5 per worker monthly and $19 per worker monthly, respectively—but it surely makes up for it with the variety of options supplied. Even with its starter tier, you get Gusto-brokered well being advantages, full-service payroll with tax submitting companies, and primary HR instruments to make managing time without work insurance policies, vacation pay, and worker profiles straightforward for you. It has three plans:

- Easy: $40 monthly plus $6 monthly per worker.

- Plus: $80 monthly plus $12 monthly per worker.

- Premium: $180 monthly plus $22 monthly per worker.

Gusto even has state tax registration companies should you need assistance setting this up for your small business. Nonetheless, pricing varies relying on the state, so should you’re on this service, let Gusto’s gross sales staff know to allow them to create a quote for you.

Whereas the above options contributed to Gusto’s 3.88 out of 5 rating, it didn’t outrank Sq. Payroll—the primary on my checklist—due to pricing. It additionally doesn’t have a cell app that allows you to run payroll whereas on the go, a performance that Roll by ADP excels in.

Gusto execs and cons

| Execs | Cons |

|---|---|

| Payroll on AutoPilot characteristic enables you to pay your self mechanically | Entry to HR advisors and compliance audits restricted to the best plan |

| Function-rich platform with a variety of HR instruments, together with world payroll and hiring companies | Direct deposit takes as much as 4 days should you’re on the starter Easy plan |

| Loads of how-tos and reference supplies to make sure ease of use | No cell app for operating payroll |

Why I selected Gusto

Gusto is likely one of the hottest payroll software program within the small- and midsize-business market. It doesn’t take a lot time to get used to and handles wage calculations and tax filings, making it a superb choice to run payroll for one worker. And should you use third-party apps, like an accounting system, Gusto integrates with tons of of software program to make your life as a enterprise proprietor simpler. It additionally has a community of 401(ok) suppliers, permitting you to discover a low-cost retirement plan with deductions that sync simply with Gusto’s payroll platform.

Study extra about Gusto

- Learn the total Gusto evaluate.

- To see how Gusto compares with a few of its opponents, try the next articles:

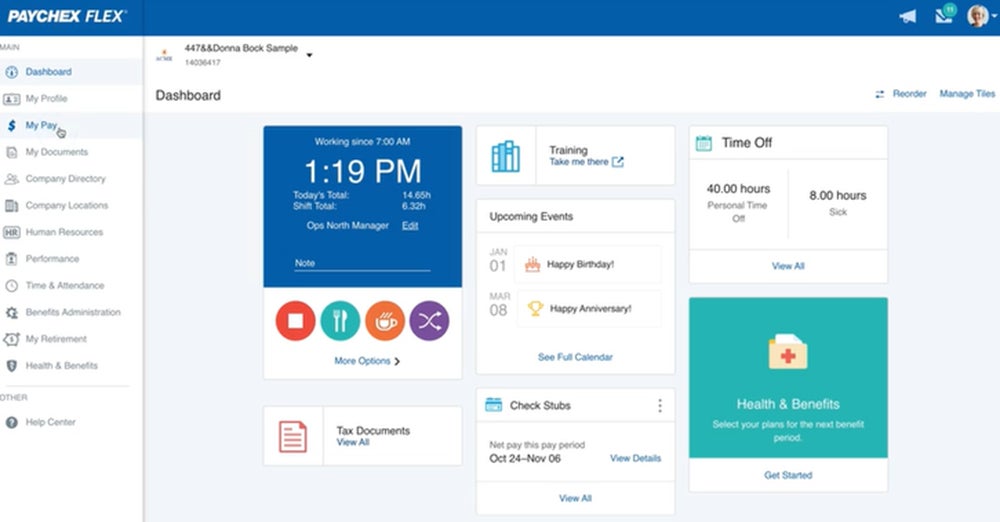

5. Paychex Flex: Greatest for tax and enterprise companies

Our ranking: 3.65 out of 5

Paychex Flex is Paychex’s all-in-one payroll, HR, and advantages platform designed for various ranges of enterprise. With this software program, you’ll be able to run automated payroll from desktop or cell units with the choice to work with a devoted payroll specialist. It additionally comes with a number of fee choices, reminiscent of direct deposits and same-day ACH funds. For a hands-off strategy to paying your self, its Paychex Voice Help characteristic enables you to use voice prompts to deal with payroll evaluations, approvals, submissions, and updates—a novel performance with Paychex.

Paychex even affords solopreneurs a single-employee payroll service with 24/7 assist and entry to a solo 401(ok) plan. Along with managing your self-employment taxes, Paychex affords knowledgeable recommendation on lowering tax liabilities via deductible contributions and S Corp financial savings. Should you need assistance with incorporation and startup companies, Paychex’s partnership with MyCorporation permits it to assist safe state and federal tax IDs, company formations, and enterprise licenses. Gusto might have comparable companies, however Paychex’s is extra in depth.

Pricing

Paychex doesn’t publish its pricing info on its web site—you need to name its gross sales staff to request a quote. For its Paychex Flex product, it affords three plans:

- Choose: Customized pricing.

- Professional: Customized pricing.

- Enterprise: Customized pricing.

It scored 3.65 out of 5 in my analysis, primarily due to non-transparent pricing. Lots of its options are additionally included in larger tiers or value additional. For instance, quick fee choices (reminiscent of same-day ACH and real-time funds) are paid add-ons to Paychex Flex plans. Worker onboarding prices additional with Paychex however is free with ADP, OnPay, and Gusto. You may additionally must pay extra charges should you join Paychex Flex with third-party accounting, HR, and hiring software program.

Paychex Flex execs and cons

| Execs | Cons |

|---|---|

| Self-employed bundle consists of incorporation companies and a solo 401(ok) plan | Non-transparent pricing |

| Straightforward to change between desktop and cell payroll processing (and vice-versa) | Add-on charges for onboarding, time monitoring, software program integrations, and advantages administration |

Why I selected Paychex Flex

Paychex is the one supplier I reviewed that has a single-employee payroll service with incorporation companies and a retirement plan for solopreneurs. I’m impressed with its enterprise companies, which embrace assist with company formations.

Like ADP and Gusto, Paychex Flex affords a number of on-line instruments to automate day-to-day payroll. I like how versatile it may be—you can begin pay runs from a desktop laptop and decide up the place you left off through its cell app. Whereas it could not have Roll by ADP’s chat-based prompts, you should use its Voice Help characteristic to course of payroll for one worker. That is nice if you wish to do a number of duties, reminiscent of operating payroll whereas answering enterprise emails or going via your checklist of shopper product orders.

Study extra about Paychex Flex

- Learn our full Paychex evaluate.

- To see the way it compares with different payroll programs, try these articles:

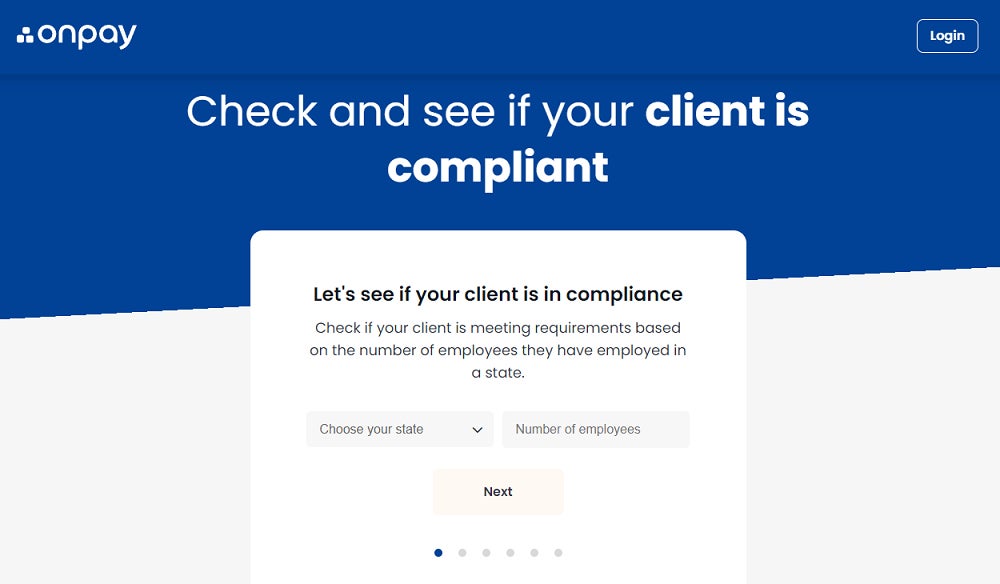

6. OnPay: Greatest for simple setup

Our ranking: 3.59 out of 5

With OnPay, you get a web based platform that may deal with pay runs for companies in all industries. This consists of these with area of interest pay processing wants, reminiscent of corporations within the agriculture sector. It processes payroll in minutes and automates tax processes—from calculations to tax fee remittances and kind filings.

OnPay additionally has a staff of execs who can deal with the payroll system setup and even create {custom} third-party software program integrations, reminiscent of {custom} pay merchandise mapping to accounting instruments like Xero or QuickBooks. These companies are free for brand spanking new OnPay purchasers however might value additional with some payroll suppliers. It even offers free knowledge migration assist, which helps you save time from manually inputting firm particulars and former pay info into the brand new system.

Pricing

For $6 per worker monthly plus a base payment of $40 monthly, you get all of OnPay’s HR and payroll options. Whereas it prices the identical as Gusto’s starter plan, OnPay offers higher worth for cash should you’re solely searching for a platform with full-service payroll and entry to advantages plans and primary HR instruments to handle onboarding, workers knowledge, PTOs, and org charts.

In my analysis, it earned a 3.59 out of 5 rating. Whereas pricing is cheap and also you get environment friendly instruments, it lacks a cell app and has restricted integration choices. For accounting, you’ll be able to solely join it with QuickBooks and Xero.

OnPay execs and cons

| Execs | Cons |

|---|---|

| Payroll platform helps a variety of industries | Restricted built-in integration choices |

| Free white-glove setup, {custom} software program integrations, and knowledge migration companies | Cellphone, chat, and electronic mail assist solely accessible on weekdays; weekend assist is through electronic mail and for emergencies solely |

Why I selected OnPay

OnPay’s free shopper assist covers extra companies than different payroll software program suppliers. This lets you give attention to operating your one-employee enterprise relatively than worrying about extra duties, like organising a brand new payroll system. You additionally get value financial savings with OnPay since you don’t must pay additional for knowledge migration or {custom} software program integrations.

Additional, should you’re not sure whether or not your one-employee enterprise meets state compliance necessities, OnPay has a web based compliance checker device. Whereas it’s for accounting corporations and accountants providing payroll companies, you should use it to determine state compliance gaps you have to handle.

Study extra about OnPay

Learn our full OnPay evaluate.

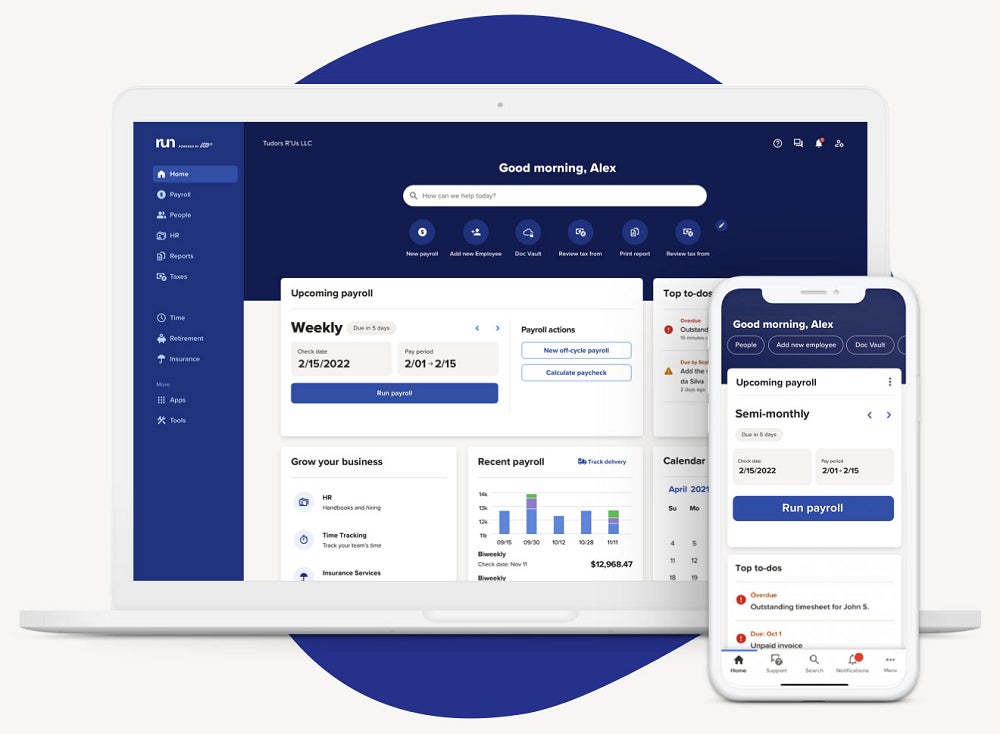

7. RUN Powered by ADP: Greatest for scalability

Our ranking: 3.58 out of 5

ADP is a payroll companies supplier that gives quite a lot of customizable and scalable payroll options for companies of all sizes. You can begin with its RUN Powered by ADP product—or ADP RUN—which comes with automated payroll options, tax submitting companies, and advantages plans. Should you determine to rent workers, this platform can deal with complicated payroll and HR processes like multi-state pay runs, state unemployment insurance coverage (SUI) administration, applicant monitoring, and background checks. It even consists of paycheck signing and supply companies in case employees want to obtain their wages through paper checks.

Should you outgrow this product and want enhanced HR and payroll options, the supplier’s ADP Workforce Now product is right for midsized to massive corporations. And should you’d relatively not deal with payroll, you’ll be able to select ADP’s PEO service, ADP TotalSource.

Pricing

ADP doesn’t checklist pricing for many of its payroll options on-line. Nonetheless, it does checklist pricing for its Roll by ADP cell payroll device, which begins at $39 a month plus $5 per worker monthly.

Most ADP merchandise have a number of plans. ADP RUN, as an illustration, has 4 custom-priced tiers:

- Important: Contains full-service payroll with tax submitting companies, direct deposit funds, paycheck supply to your workplace (should you want it), payroll studies, worker reductions, and entry to a Google Adverts device for operating campaigns

- Enhanced: Important + job costing and paycheck signing companies with safe checks

- Full: Enhanced + wage benchmark and entry to HR types and paperwork

- HR Professional: Full + internet optimization instruments, advertising and marketing recommendation from Upnetic advisors, and authorized help from Upnetic authorized companies

The Important plan is right for primary payroll processing. Should you join its larger tiers, you get extra HR functionalities and payroll companies, reminiscent of paycheck signing and SUI administration. Nonetheless, it solely scored 3.58 out of 5 in my analysis as a result of, just like Paychex, pricing isn’t clear. It’s essential contact the ADP gross sales staff to get the worth for every ADP RUN plan.

RUN Powered by ADP execs and cons

| Execs | Cons |

|---|---|

| Actual-time pay run error alerts | Well being advantages and retirement plans are paid add-ons |

| Advertising and marketing toolkit from Upnetic to assist one-employee companies construct, develop, and handle digital companies | Prices charges per pay run |

Why I selected RUN Powered by ADP

ADP affords a variety of payroll software program services and products for companies of all sizes. Its payroll plans and on-line instruments can scale together with your firm. You possibly can join ADP RUN to course of payroll for one worker at times transfer on to different ADP merchandise should you want extra superior HR instruments to deal with a bigger workforce sooner or later. And because you’re coping with just one payroll supplier, migrating payroll and worker knowledge between ADP merchandise is simpler in comparison with switching to a web based system supplied by one other supplier.

Whatever the product chosen, ADP helps you keep compliant with IRS and different rules whereas guaranteeing correct and well timed worker payouts.

Study extra about ADP RUN and different ADP merchandise

- Learn our full ADP evaluate.

- Uncertain whether or not to get ADP or a unique payroll software program? Test these out:

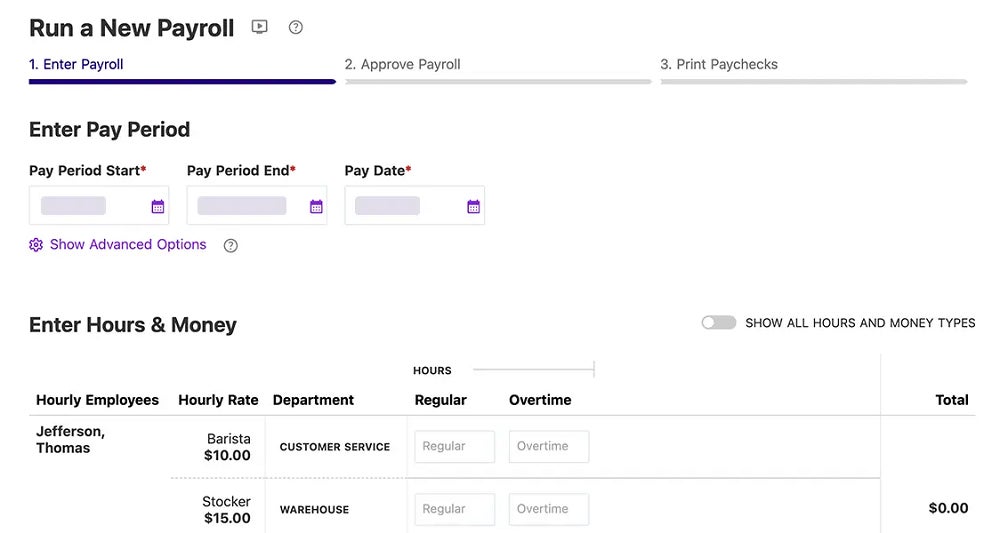

8. Patriot Payroll: Greatest for versatile pay runs

Our ranking: 3.49 out of 5

Patriot Payroll is a web based pay processing software program with automated payroll and tax calculations. It has versatile payroll choices that mean you can select a full-service bundle with tax submitting companies or primary pay runs the place you deal with all tax filings. I like to recommend getting the primary choice, particularly should you’re new to operating a one-employee payroll and not sure which tax types to file. Nonetheless, should you’re adept at dealing with self-employment taxes and like to file tax types your self, Patriot’s primary payroll bundle could also be best for you. In case you modify your thoughts, you’ll be able to simply improve to its full-service payroll plan to automate tax fee and submitting processes.

Pricing

With Patriot Payroll, you get two plans:

- Fundamental payroll: $17 monthly plus $4 per worker monthly.

- Full-service payroll: $37 monthly plus $5 per worker monthly.

I gave Patriot Payroll a 3.49 out of 5 for its fairly priced plans and pay processing options. I like that it has an accounting system that connects with its payroll module, making knowledge transfers between the 2 merchandise straightforward. Much like QuickBooks, you will get it as an add-on answer however at barely cheaper charges. Month-to-month prices for Patriot Payroll with the accounting module begin at $47 plus $5 per worker, whereas QuickBooks costs month-to-month starter charges of $85 plus $6 per worker for its payroll and accounting bundles.

Nonetheless, should you want extra invoicing functionalities, QuickBooks affords {custom} invoices and reminder instruments with its starter accounting bundle. Its payroll platform additionally affords next- and same-day direct deposits. Patriot’s customary direct deposit timeline is 4 days. It has a two-day choice, however just for certified purchasers.

Patriot Payroll execs and cons

| Execs | Cons |

|---|---|

| Reasonably priced primary payroll bundle should you want to file tax types your self | Two-day direct deposits just for certified clients |

| Payroll knowledge syncs simply with its accounting module | Restricted HR instruments |

| Solely integrates with QuickBooks |

Why I selected Patriot Payroll

As a self-service payroll plan, Patriot’s primary bundle may also help you get monetary savings, particularly when you’ve got a restricted finances. Nonetheless, I solely suggest this for solopreneurs with expertise remitting and submitting taxes themselves.

Even should you join its full-service plan, Patriot Payroll affords a inexpensive choice than Gusto and OnPay. Nonetheless, it’s not as inexpensive as Deel’s US payroll product—offered you solely must pay one employee. Whereas it could not have the HR functionalities these programs supply, Patriot Payroll has all of the important instruments to compliantly and precisely handle one-employee pay runs.

Study extra about Patriot Payroll

9. Roll by ADP: Greatest for cell payroll

Our ranking: 3.47 out of 5

Roll by ADP is ADP’s chat-based cell app designed for microbusinesses, together with one-employee corporations. It makes use of generative synthetic intelligence (AI) instruments that can assist you run and optimize worker fee processes. Not like the ADP RUN app, it solely runs on cell units and doesn’t embrace HR instruments and advantages plans, however it will probably deal with taxes and kind filings, deductions, and garnishments with ease.

Whereas you could modify to typing chat instructions for Roll by ADP to make payroll changes, replace information, and begin a pay run, the training curve isn’t steep should you’re tech savvy. This cell app additionally guides you thru the relevant steps, though Roll by ADP’s assist staff can also be accessible to speak 24/7 when you’ve got questions on its options.

Pricing

Roll by ADP is the one ADP product that gives clear pricing. For a base month-to-month payment of $39 plus $5 per worker monthly, you get full-service payroll with tax submitting companies. That is inexpensive than Gusto, OnPay, and QuickBooks Payroll—all of which lack downloadable cell apps that may run payroll whilst you’re on the go.

Its cell pay processing options might have contributed to its general rating of 3.47 out of 5, but it surely wasn’t sufficient to rank larger on my checklist due to its restricted companies. You gained’t get suggestions for a solo 401(ok) plan and enterprise incorporation help as you’ll with Paychex. It additionally solely integrates with QuickBooks—so should you’re utilizing a unique accounting system, think about different payroll software program suppliers like Gusto, ADP, or Sq. Payroll.

Roll by ADP execs and cons

| Execs | Cons |

|---|---|

| Pays through next- or same-day direct deposits | Solely integrates with QuickBooks |

| Free tax financial savings consultations with a tax knowledgeable | Restricted payroll studies |

| Consumer-friendly app with GenAI instruments | No HR instruments |

Why I selected Roll by ADP

Processing one-employee payroll with Roll by ADP is simple. You solely must sort “Run payroll” or an identical chat command (e.g., “Begin payroll”), and it’ll deal with all wage/tax calculations and deductions. It additionally walks you thru the method and sends real-time pay error alerts.

What impressed me most is its AI instruments, which study out of your chat instructions. For instance, you don’t want to inform Roll by ADP to create and observe a payroll schedule. It seems at whenever you usually ask it to run payroll, enabling it to line up your subsequent worker fee duties and ship reminders about it. The opposite payroll programs on my checklist don’t have this characteristic.

Study extra about Roll by ADP

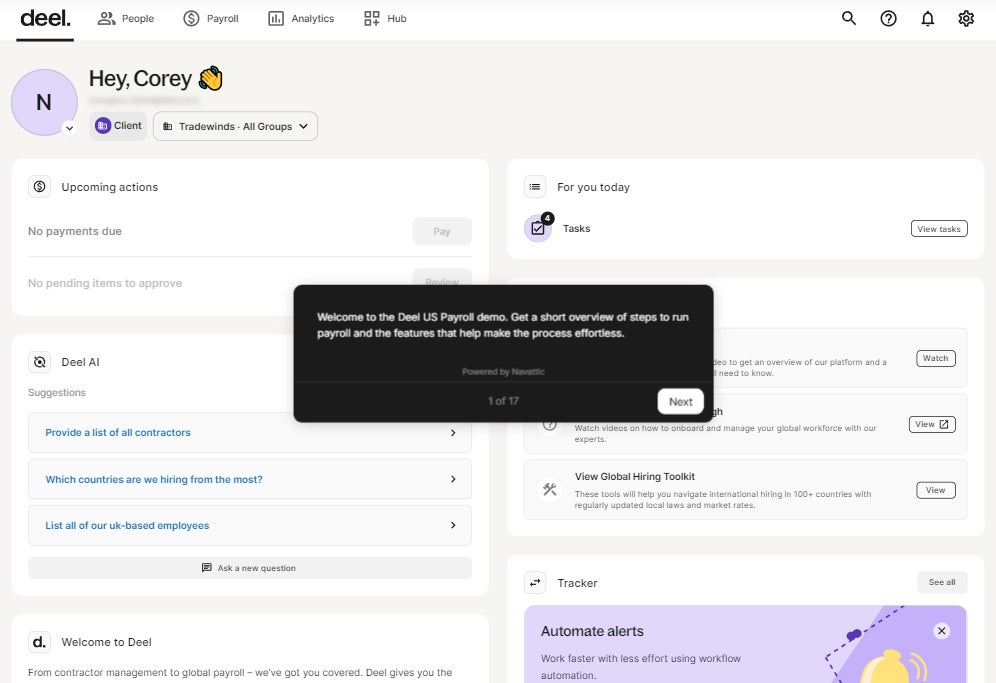

10. Deel: Greatest for affordability

Our ranking: 3.47 out of 5

Deel affords a variety of worldwide and US payroll instruments, together with a US PEO choice and an employer of report (EOR) service for hiring and paying world employees. On your one-employee enterprise, Deel has a US payroll choice with month-to-month charges that begin at $19 per worker. This plan consists of automated tax and wage calculations, tax filings in any respect ranges (federal, state, and native), on-demand payroll compliance assist, and registration help in 50 states. It additionally assigns a devoted customer support supervisor who can reply your Deel-related questions.

It additionally affords varied assist articles, payroll guides, and a library of templates and HR assets with tricks to make managing a worldwide workforce straightforward for you. Should you want a fast information to utilizing its key US payroll options, it has a web based demo you’ll be able to entry.

Pricing

Month-to-month charges for Deel’s US payroll product begin at $19 per worker. That is the most cost effective plan on my checklist—offered you solely use it to pay one worker. Nonetheless, should you determine to develop right into a multi-employee enterprise, Deel’s US payroll bundle is pricier than the opposite pay processing software program on my checklist. For instance, when you’ve got 10 employees, Deel will cost you $190 monthly, whereas Roll by ADP and Gusto solely value $89 and $100 monthly, respectively.

Along with its US payroll product, Deel affords a US PEO service and world instruments for hiring and paying worldwide employees.

- Deel US PEO: Begins at $89 per worker monthly.

- Deel Payroll: Begins at $29 per worker monthly; consists of world payroll-only instruments.

- Deel Contractor: Begins at $49 monthly; consists of contractor funds in additional than 150 international locations.

- Deel EOR: Begins at $599 monthly; consists of worldwide payroll and hiring instruments.

Deel scored solely 3.47 out of 5 in my analysis as a result of whereas it affords an inexpensive US payroll product, it lacks the automated pay runs and quick fee choices offered by some suppliers on my checklist. It additionally solely affords chat and electronic mail assist to its purchasers.

Deel execs and cons

| Execs | Cons |

|---|---|

| Has a variety of US and world payroll instruments | No cell app for operating payroll |

| Free HR info system (HRIS) for managing workers knowledge | Will get dear should you add extra workers |

Why I selected Deel

Whereas Deel tops our checklist of the very best EOR companies, its US payroll product can also be a superb choice for paying just one worker. It affords the automated payroll calculations and tax submitting companies that Gusto, OnPay, and QuickBooks Payroll present of their subscription plans, however at a lesser month-to-month payment. This allows you to save on payroll software program prices and use what you saved for product enhancements or promoting applications to advertise your small business.

Like ADP and Justworks, Deel has a PEO choice should you don’t need to deal with payroll. If your small business plans embrace increasing to international locations exterior the US, Deel’s EOR companies may also help handle your worldwide payroll and hiring wants.

Study extra about Deel

- Learn our full Deel evaluate.

- Test these articles to see how Deel compares with different payroll suppliers:

Key options of one-employee payroll software program

When selecting payroll software program for a one-employee enterprise, these are important options to contemplate in your choice course of.

- Scalability: You could be a one-employee enterprise now, however you could must scale your organization within the close to future. The payroll software program you choose ought to accommodate your rising pay processing necessities, reminiscent of multi-state pay runs should you increase your small business to totally different states the place some might have totally different labor legal guidelines and tax rules.

- Automation: Operating a one-employee enterprise the place you’re chargeable for totally different facets of enterprise development and the dangers concerned might be taxing. Having a payroll answer the place all you could do is ready up the software program to deal with payroll even when you’re not trying is a characteristic your most well-liked payroll answer ought to have.

- Consumer-friendly: The flexibility to make use of any enterprise software program device with out encountering many difficulties is essential to how profitable you’ll be whereas utilizing the device. The identical goes for payroll software program. Contemplate an answer with an easy-to-navigate interface, easy set up, explicable studies, versatile integrations, and plentiful assets on methods to use the software program.

- Safety: Payroll includes the motion of funds, tax particulars, and different types of personally identifiable info. With knowledge breaches on the rise, cybercriminals are sometimes interested in such info and search for vulnerabilities to use. Due to this fact, it’s necessary to contemplate if the payroll software program you need meets business knowledge safety requirements.

- Customization: As a one-employee enterprise proprietor, you’re possible extra keen on having issues run as simply as potential. One option to obtain that’s having a web based system you’ll be able to customise to your customary. As an illustration, your payroll report would possibly comprise in depth info you think about irrelevant and distracting. Nonetheless, you’ll be able to customise this report to suit your wants.

How do I select the very best one-employee payroll software program for my enterprise?

Selecting the very best one-employee payroll software program for your small business requires cautious consideration. Listed below are some recommendations on how one can make the fitting selection.

Contemplate the options

Payroll software program options fluctuate extensively relying on the seller and bundle you select. Some supply primary options for calculating taxes, producing pay stubs, and making direct deposits. Others present extra superior options like trip and sick time monitoring, worker advantages administration, and tax filings. That can assist you select a payroll service, create a payroll processing guidelines and decide which options are important in your one-employee enterprise.

Test for compliance

Payroll taxes might be complicated, and as a one-employee enterprise proprietor, you will not be conversant in all of the tax legal guidelines and rules that apply to your small business. You need to select payroll software program that mechanically calculates and deducts payroll taxes and ensures all taxes are filed accurately and on time. Test if the software program affords computerized tax calculation, tax kind era, and reminders for tax deadlines.

Contemplate integrations

In case you are already utilizing accounting or bookkeeping software program, selecting a payroll answer that integrates together with your present answer is crucial. Integrations assist you keep away from guide knowledge entry and scale back the danger of errors.

Search for inexpensive pricing

Worth is a major issue when selecting payroll software program. As a small enterprise proprietor, you could be sure that the software program suits your finances. Search for payroll software program that gives inexpensive pricing with no hidden charges or costs.

Test if the software program you need affords a free trial and join it. Throughout that interval, you’ll be able to consider whether or not the options justify the price.

Contemplate buyer assist

Even with user-friendly software program, you could want help or have questions or considerations in regards to the platform. Due to this fact, it’s essential to decide on payroll software program with glorious buyer assist. Test if it has a number of assist channels like cellphone, electronic mail, chat, or a information base. Then, select a software program vendor that gives responsive, educated, and useful customer support.

Payroll for one-employee companies FAQs

Ought to I exploit a payroll service for one worker?

Sure, it’s best to. There are numerous explanation why your small business wants a payroll service, even should you solely have one worker. With a payroll service supplier, you decrease the danger of pay-related errors whereas guaranteeing correct and well timed worker funds. It additionally helps you save time from operating payroll, permitting you to focus extra on day-to-day enterprise operations and implement methods that assist develop your organization.

Can I do payroll and not using a payroll service?

Whereas managing payroll your self is feasible, I like to recommend it solely when you’ve got primary payroll wants and have fewer than 10 workers to pay. You also needs to be conversant in payroll tax rules and labor legal guidelines and be keen to deal with tax funds and kind filings with acceptable authorities companies.

Easy methods to run payroll if self-employed?

Operating self-employed might be complicated and requires a number of steps. The primary is securing the required federal and state tax IDs. Then, you could choose a fee frequency that meets state necessities. You also needs to determine your small business entity or construction (e.g., sole proprietorship or S Corp) as a result of this could affect taxes. After getting these in place, the essential strategy of paying your self consists of calculating gross wages and withholding the relevant payroll taxes and deductions. You need to additionally remit tax funds and file the suitable tax types to the IRS.

For a step-by-step information, try our methods to do payroll information.

Methodology

To find out the very best payroll software program for one-employee companies, a collaborative evaluation was made utilizing a rubric with standards that thought-about pricing, platform functionalities, payroll options and companies, buyer assist, and consumer evaluations from third-party evaluate websites like G2, Capterra, and TrustRadius.

A complete of 16 payroll software program had been evaluated the place I used in-depth analysis, accessible free trials or demos to grasp every platform’s functionalities, and my over 5 years of expertise reviewing payroll programs to offer knowledgeable scores and slim the checklist to the highest 10 choices. Under is an inventory of the software program I reviewed.

- Roll by ADP

- Gusto

- QuickBooks Payroll

- Paychex Flex

- OnPay

- Sq. Payroll

- Paycor

- Patriot Payroll

- Wave Payroll

- Justworks

- Deel

- SurePayroll

- APS Payroll

- Bambee

- Buddy Punch

- RUN Powered by ADP

Right here’s a breakdown of the rubric’s scoring standards:

- Pricing: Weighted 20% of the entire rating.

- Platform/interface options: Weighted 20% of the entire rating.

- Payroll companies: Weighted 15% of the entire rating.

- Payroll options: Weighted 25% of the entire rating.

- Buyer assist: Weighted 15% of the entire rating.

- Consumer evaluations: Weighted 5% of the entire rating.

Different consultants who contributed to this text’s rubric evaluation embrace:

- Irene Casucian who carried out the preliminary software program analysis and objectively scored the rubric primarily based on particular standards.

- Jessica Dennis who created the rubric’s standards and chosen the merchandise for Robie and Irene to evaluate primarily based on her hands-on expertise with HR software program, her payroll experience, and her over six years of expertise as an HR generalist.